When I speak to people these days, I get a strong sense of uncertainty about the markets and in particular stocks. I don’t blame them. If you watch or read any financial news, you are bombarded with news that would make you question your decision to own stocks.

Despite these, dividends are an ideal source of income for multiple reasons. Studies show that people with multiple sources of regular recurring income are happier than those who are limited to spending their investment principal for their livelihoods.

Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.

– John D. Rockefeller,

One of the richest men in modern history

Many companies pay their dividends on a regular basis, so developing a portfolio that is diversified with companies in various industries and with a history of paying increasing dividends has been a highly satisfying way for many to invest.

Returns from dividends have provided much comfort to people currently in retirement as well as those planning their retirement well into the future. A guided plan can be your key to consistent, reliable investment income. So, be like John D. Rockefeller; take pleasure and enjoy your dividends. Be happy and stop stressing about the daily volatility of the market.

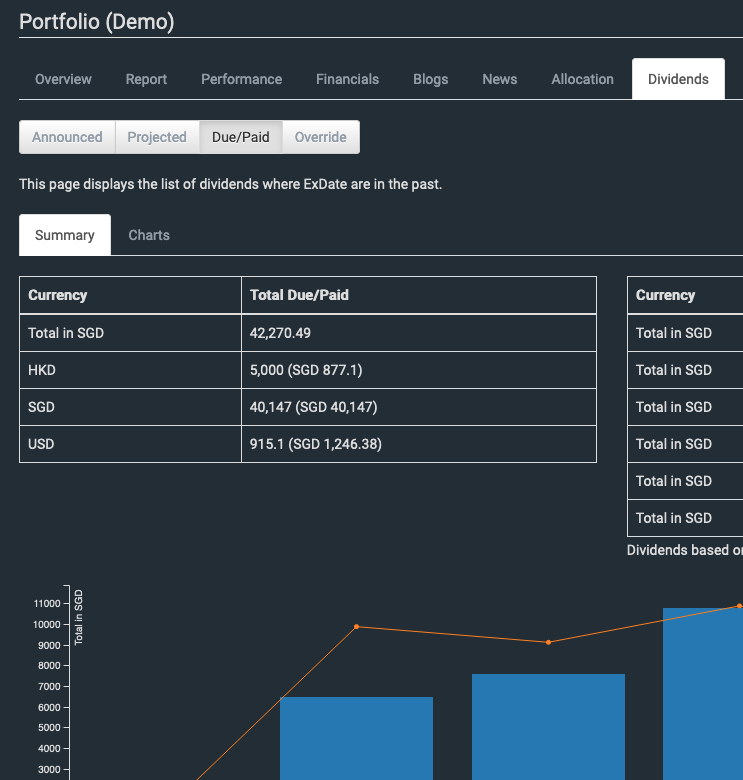

It is equally important to track the dividends’ income too. However, it can be a nightmare when you have a diversified portfolio with several trading accounts. The issue gets even more complicated when you hold stocks in overseas currencies.

StocksCafe takes care of all these for you. Let’s hear directly from a StocksCafe user, Millennial SG Dad. He shared a detailed post of how StocksCafe has helped him in tracking his dividends.

Do you also use StocksCafe to track your dividends? Why or why not? Let us know by commenting!

I must also say that the dividend tracking feature is a fantastic tool to keep track of dividends flow from my portfolio, particularly as I have assets across those in CDP and those in custodian accounts. As stockscafe also tracks the dividends overtime, this also allow you to adjust the asset mix to improve the dividend flow over time. Specifically I group the assets by whether they are for dividends or for growth so that I assess the respective performances as how they were meant for.

Love StocksCafe for dividend tracking & projections. With regards to ‘investing for dividends’, caution has to be exercised to not look at them as fixed income or assume they will keep going up. The safest companies paying consistent dividends may not be in business a decade from them. The downfall will not be sudden and market will price over time. If the investor is not watchful, the dividend yield will look optically attractive (past dividend compared to current prices).