It has often been advocated to avoid any stocks with a high P/E. The common argument is that you would be overpaying for hype stocks.

However, overpaying or not depends on how the high P/E stocks behaves in future. For example, if high P/E stocks actually do grow at a rate that is significantly higher than low P/E stocks, then it is arguably justifiable to buy stocks with a high P/E. One real-life example for this is Amazon. It has a notoriously high P/E for as long as the stocks exist, however, the stock price has also been growing exponentially.

Of course, this is only one counter example. In this article, I would demonstrate in general if a higher P/E means higher growth in the context of the Singapore stock market.

In particular, I am going to look at the following two dimensions:

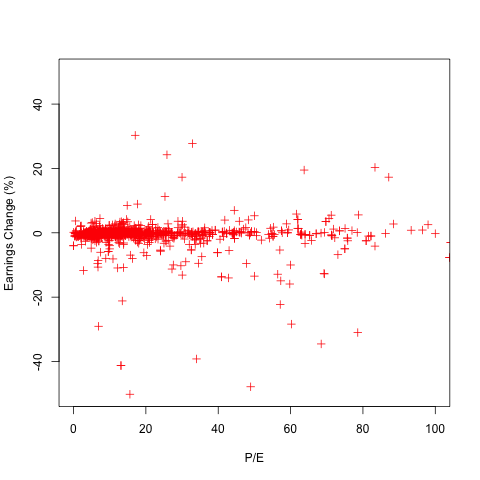

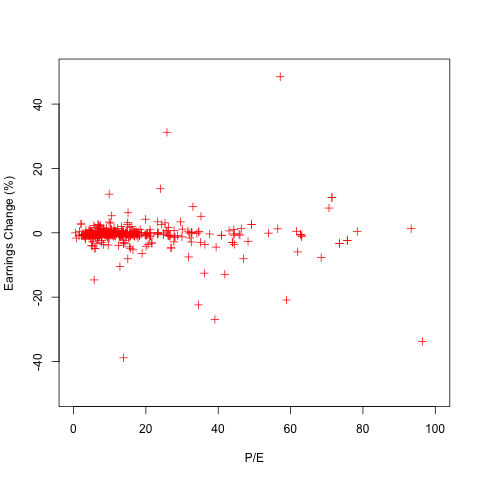

1) P/E vs Earnings Change

Does a higher P/E lead to higher earnings change going forward (1 year and 3 years)? By paying for a high P/E, investors are betting that the earnings of the companies will grow significantly such that it is worth paying for the high P/E upfront.

Looking at the two graphs above, it is obvious that as the P/E (x-axis) increases, it does not influence earnings change.

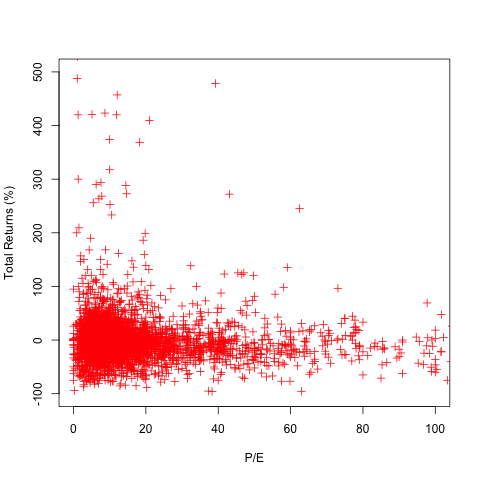

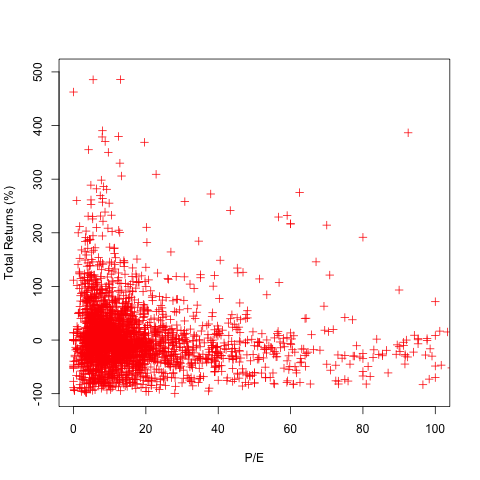

2) P/E vs Total Returns (Price Change + Dividends Gained)

Does a higher P/E leads to higher total returns going forward (1 year and 3 years)? Ultimately, investors want to earn returns on investments. It is certainly worth paying for high P/E if it gives us higher total returns.

Similarly, Figures 3 and 4 above show that as the P/E (x-axis) increases, it also does not affect total returns.

To be more mathematically rigorous, I have computed the Spearman correlation for them as well.

P/E vs Earnings Spearman (1 year): -0.0085

P/E vs Earnings Spearman (3 years): -0.0580

P/E vs Total Returns Spearman (1 year): -0.1437

P/E vs Total Returns Spearman (3 years): -0.1871

What the Spearman correlation tells us is that there is no correlation between P/E and Earnings, and that there is a slight negative correlation between P/E and Total Returns. Essentially, it is saying that the P/E does not influence Earnings, but a higher P/E causes slightly lower Total Returns.

The conclusion of the results is: although it is not worth paying for high P/E, it is not necessary to avoid them completely.

Happy investing!

—

Methodology

For those that are interested in the methodology on how the data points are generated.

1) P/E vs Earnings (1 year)

Taking all end of year P/E between 2010 and 2015, pair it with the change of earnings between then and one year later. Total data points available were 1,292.

2) P/E vs Earnings (3 years)

Taking all end of year P/E between 2010 and 2015, pair it the change of earnings between then and three years later. Total data points available were 410.

3) P/E vs Total Returns (1 year)

Randomly picking ten dates between 2010 and 2015, use the P/E and pair it with the change to total returns between then and one year later. Total data points available were 2,973. Note that total returns is computed by (“one year later close” + “dividends given out during this period”) / “current close” – 1

4) P/E vs Total Returns (3 years)

Randomly picking ten dates between 2010 and 2015, use the P/E and pair it with the change to total returns between then and three years later. Total data points available were 3,430. Note that total returns is computed by (“one year later close” + “dividends given out during this period”) / “current close” – 1

Note that I have also cut off the graph where the P/E is greater than 100 as they are sparse outliers which made the graph harder to view.

hmm, i feel something is not exactly correct, but cannot tell precisely. something to do with sufficient condition, necessary condition.

Always happy to have my articles peer-reviewed. Let me know if you managed to pinpoint the weakness.

The y-axis for P/E vs Earnings Change (1 year) really need some tinkering. Should have reduced the range, i think.

Actually I wasnt surprised by this fact – slight negative correlation between P/E and Total Returns. Really plays into the theme of value investing by the more traditional investors like Benjamin Graham.

My view is, I will buy only if very very sure the company’s earning growth rate will turn down the P/E below 15 after 2-3 years. If not I would rather choose other stock. There are so many company in market, we have enough choice to avoid this company.

@seekingprivatereturn, good point. Updated the graphs to more reduced range.

@sggamelover, I see. I guess what I learn from this is that P/E is just one dimension to consider but not necessary the condition that MUST be satisfy before proceeding (i.e. If current P/E >20, then throw company aside)

@evankoh Warran Buffet once said

âFor the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments.â

We should always buy a wonderful company with fair price. If don’t have this kind of company, we can just wait for them to appear. But the fact is, there are always have this kind of companies in all market around the world.

@sggamelover, I am not sure if you are implying that high P/E implies “too-high purchase price”. If yes, I do not agree 🙂

Since P/E simply means price over earnings and earnings can be low for various reasons due to accounting styles which does not always mean a company is unhealthy.

how i interpret this scatter plot is that majority (it looks like to me anyway) have negative returns, regardless of their P/E… conclusion is P/E is not a useful indicator to determine returns.

@jarwey, maybe you are right 🙂

Perhaps u would like to go back to the drawing book, how and why u setup this website? Will it cost so much to run then? The cost increased is it because of additional market data that it may or may not necessary. I am sure additional friend or free user should not raise the cost to maintain this site, rather they should still be able to ease your burden in hosting and bandwidth demand…i bet it must be various data feed that is killing….perhaps a end of day data may be sufficient for less popular features…..cutting off your free user may not be ideal as after all, these r the main reason attracting us and for my case eventually converted.

I was searching for some information about Amazon stock today and came across this page: https://finance.yahoo.com/quote/AMZN I noticed that you linked to that page in your post here. Just wanted to give you a heads up that I created a post about Amazon Stock you might like, but more thorough and up to date: https://investormint.com/investing/amazon-stock Might be worth a mention on your page. Either way, keep up the awesome work! Cheers, ~George